How do I combine active and passive investments

The time machine method

I have made all kinds of mistakes with my stock picks:

Bought a wrong stock.

Bought the right stock but way too early.

Sold too early.

Held too long.

(You name it.)

Did I lose money? No, I usually gained something, but almost every time I felt I could get from much more. An example: buy at 100, sell at 120, than see how the stock soars to 150 in one month. Agrhh, frustrating.

Part of this feeling is just FOMO, and it comes with the territory. But the main reason was that I just pounced like a hawk on every promising opportunity. I had no thought-out approach. Luckily, after a dozen such cases I finally came up a system to play the long game.

What do I do with stocks that have gone up

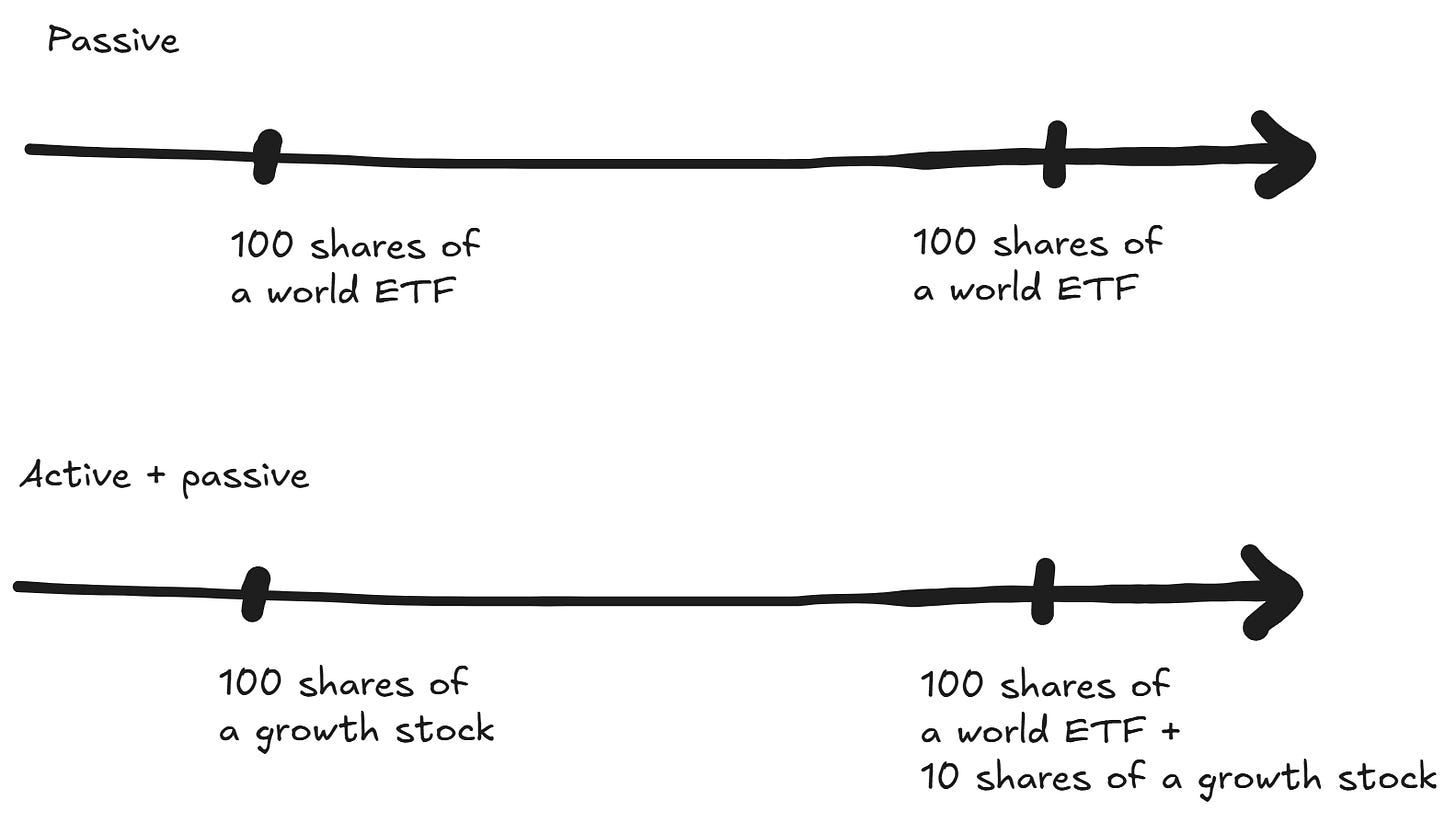

It all comes down to the goal of active investing: to gain more money than a passive index fund. The system must allow only the sales that reliably lead to outperformance, it should be hardwired. After I realized that, the rest was simple.

Here is my current process.

I notice that one of my stock picks is surging.

I calculate how many shares of a world stock market ETF I could have bought back then (on the date when I bought the stock).

I calculate how much money I need to buy the same number of world ETF shares now.

I calculate how many shares of my active bet I need to sell to get this sum (accounting for taxes and transaction costs) — and how many will remain after selling.

If I can retain at least 10% of my initial position, I sell the number of shares calculated in the previous step and immediately use the gains to buy the world ETF.

So, if my stock pick turns profitable, I use this profit as fuel for a time machine: the result is exactly the same as if I had bought the passive index and got some additional stock shares for free.

Of course they are not free. The price I paid is the risk I took. There is always an ugly possibility that the stock you bought goes down, no matter how awesome it looks.

How does it work in practice? Here are my recent trades with Nebius:

On 12 September I bought 100 shares per 75 euro. On 29 September: the price was 95 euro.

Let’s check the Vanguard FTSE All-World UCITS ETF performance for this period. The price went from 138.39 to 139.65. So, 7500 euro would buy me 7500/138.39 = 54.2 shares. I always round up to be on the safer side, so I need to buy 55 shares, which means I need 55*139.65 = 7680.75 euro. Selling 90 shares of Nebius yields 90*95 = 8550. Realized taxable profit was 1800 (8550 - 75*90). Even if transaction costs and taxes eat 500 euro, I can still buy even more ETF shares than planned. Which I did.

Now I can hold my remaining shares of Nebius indefinitely without any worries. I got them “free”, remember? No FOMO when the stock soars. No panic if it sinks. I’ve already caught up with the index, so anything left in the stock is just extra. As long as it’s worth something, I have beaten the passive-only strategy.

Initially I thought about this principle as only of a cheat sheet “what to do when your bet does well”. But actually it forces me to think systematically about all the stages of investing:

I intend to hold the part of my successful active bets indefinitely → it only makes sense to buy high-quality businesses, able to deliver results in the future, not chasing hype.

I will sell more than half of the position in the near future → my bet should be big enough so the remaining part can be noticeable in my portfolio → I need to make fewer bets → I go only for the best opportunities I strongly believe in.

10% actually is a simplification. I started with this arbitrary threshold, but quickly realized that I need individual targets for each investment.

Nebius trade was an exception: I bought it without proper research, just on the assumption that market evaluates a strong and unexpected signal not momentarily, and the momentum will continue. That’s why I kept the position small and sold at 10% threshold.

Is this the best system that works for everyone? No. It works for me now, but there is no way to be sure that there will always be enough good opportunities for stock picks. Or that selling the majority of the shares and switching to the world index is better than just staying in promising stocks forever.

And most importantly: it is not an investment strategy, it is a self-management strategy. A way to avoid doing dumb things when the market is moody, sleep better, and stay on course.

This publication is for informational and educational purposes only. It is not investment advice, tax advice, or a recommendation to buy or sell any security. I am not a licensed financial advisor. Investing involves risks, including the possible loss of capital. Always do your own research or consult a professional before making financial decisions.