Stock spin-off investing: does it still work today?

A backtest of 2023 spin-offs

“You can make a pile of money investing in spin-offs. The facts are overwhelming. Stocks of spin-off companies significantly and consistently outperform the market averages.”, wrote Joel Greenblatt in 1997.

A spin-off means creating a new company by separating a division from an existing company. Shareholders of the parent company become shareholders of both companies.

There are plenty of reasons why the “child” may be undervalued. For example, big institutional investors may not want to bother with a new, unknown small-cap and sell the stock. A proponent of the approach can name a lot of other reasons — including plainly irrelevant today, like insufficient data coverage. What matters, though, is whether the facts still support the idea now, a quarter of a century after the publication. Let’s take a look.

The portfolio: 16 spin-offs from 2023

“GEHC”, GE HealthCare

“STHO”, Star Holdings (iStar legacy)

“CR”, Crane Company

“KVUE”, Kenvue (J&J)

“KNF”, Knife River

“FTRE”, Fortrea

“PHIN”, PHINIA

“BATRA”, Atlanta Braves Holdings (split-off)

“VSTS”, Vestis

“VLTO”, Veralto

“KLG”, WK Kellogg

“LAC”, Lithium Americas (NA) post-split, NYSE

“NATL”, NCR Atleos

“NLOP”, Net Lease Office Properties

“MURA”, Mural Oncology

“WS”, Worthington Steel

I took only spin-offs available without friction, no over-the-counter stocks.

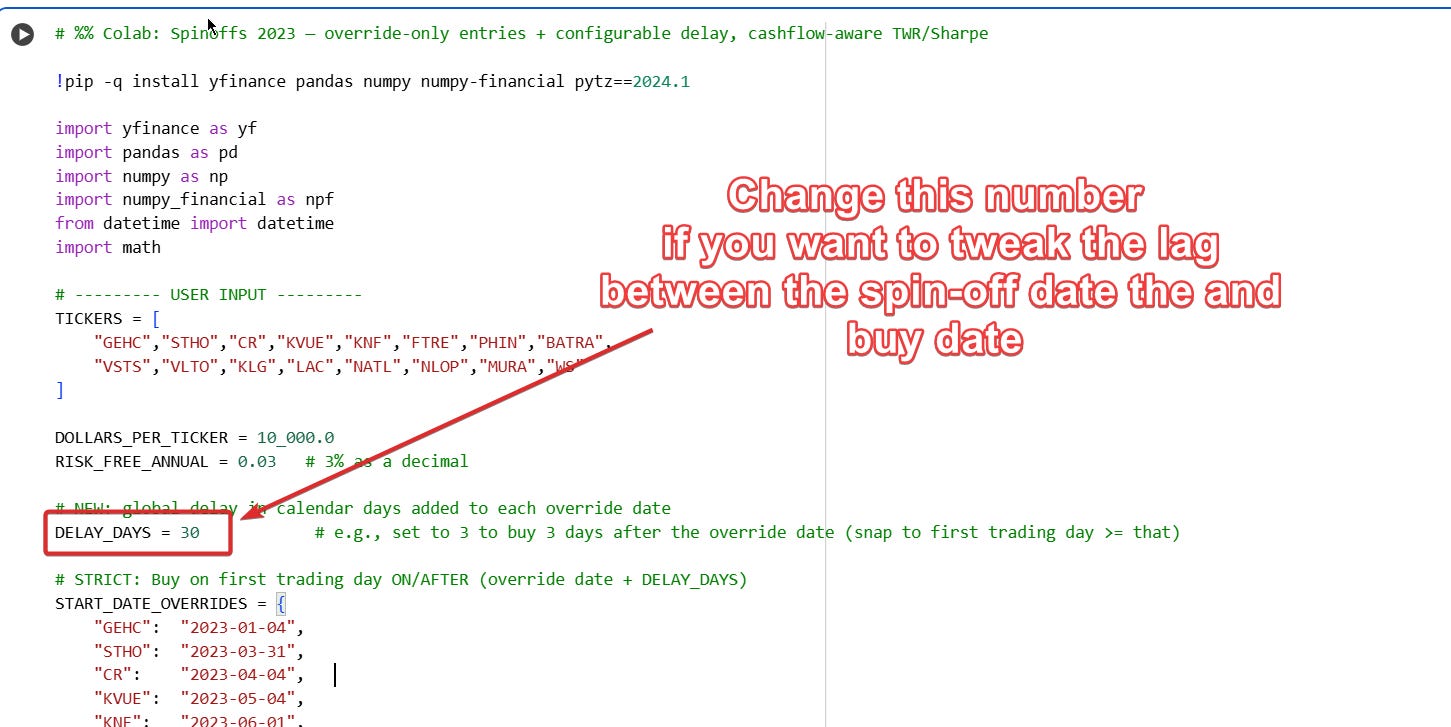

Then I used a Python script that calculates the portfolio’s performance, assuming we invest $10,000 in each stock and hold. I tried several options: buying on the first date available and with a 10-, 20-, 30-, or 60-day delay. The delay is an important part: if we believe the mispricing comes from a sell-off by institutions and index funds, we need to give them time to do so before entering.

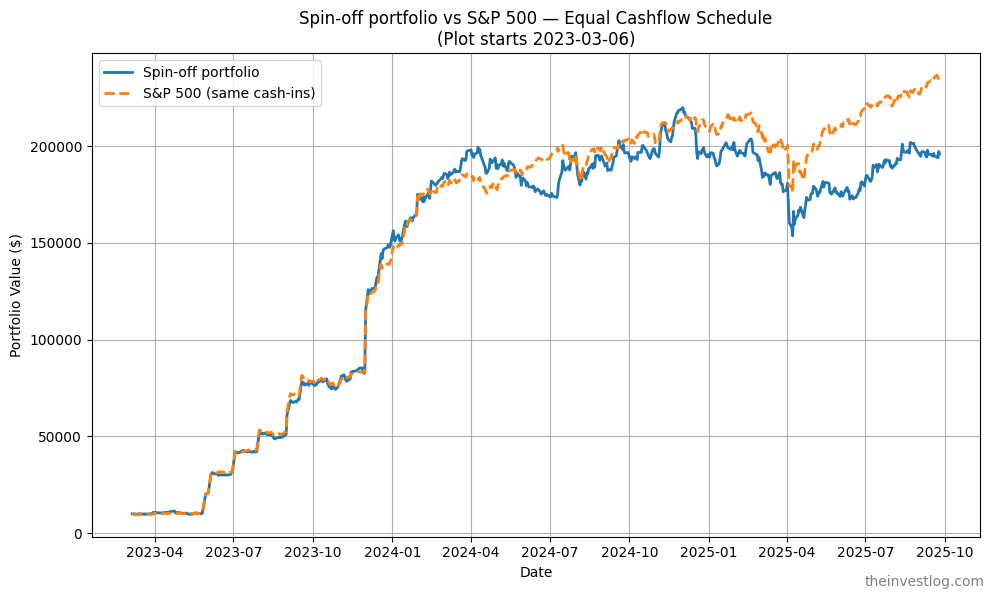

The result: drastic underperformance compared to the S&P500

Here are the results for our 60-day-delay strategy vs. the S&P 500 (assuming we buy the index on the same date we buy a spin-off):

Total invested: $160,000.00

Current value: $195,999.94 (S&P 500: $233,537.43)

Total return ($): $35,999.94 ($73,537.43)

Total return (%): 22.50 % (45.96 %)

IRR (annualized): 10.78 % (20.99 %)

TWR (cumulative): 32.88 % (63.14 %)

TWR (annualized): 11.77 % (21.12 %)

Actually, no matter how many days we wait, the picture is the same: roughly similar performance in 2023–2024, then drastic underperformance in 2025.

Examples:

0 days delay — total return is $44,264.73

10 days — $40,835.32

20 days — $39,730.43

30 days — $45,216.75

You can find this script here (works in browser) and adjust settings to see the variations of the strategy.

Shall we still monitor spin-offs?

This backtest does not prove that spin-offs cannot be a source of alpha. After all, it is only a one-year cohort. On the other hand, I picked 2023 for a reason. It is recent enough to capture modern trends but old enough to give our portfolio time to show itself (which did not happen). So we have evidence as strong as one case can deliver.

Mechanically buying every spin-off, we are likely to get a market-level performance (adjusted for industry and size).

Sometimes simple strategies work (usually when they are in perfect alignment with the current market regime). I recently wrote about one such case:

As you saw, spin-offs are a different story. That does not mean we should ignore them. In the 2023 selection, we got 3 stocks that delivered a return of more than 100% in two years. Not bad.

I think spin-off announcements can serve as a source of investing ideas. Not a strategy for guaranteed outperformance, but a hunting ground where we can find promising stocks for thorough research.

Footnotes for nerds

When I checked the material before publication, I found that KVUE and BATRA were actually split-offs, not spin-offs. I decided to leave them as they are, this error actually suited the naive strategy: buys are triggered by every press release without deep understanding. Excluding them did not change the overall picture. For 60-day delay the total performance is $37,779.74. Colab script.

Data source — Yahoo Finance; returns calculated using adjusted close.

To simplify the process, I calculated performance until 2025-09-25 (the last day KLG was traded), no matter what delay period was chosen.

Sharpe ratio (annualized, risk free rate 3.00%, 30-day delay): 0.48.

Transaction costs and taxes were not taken into account. But they would make the picture worse for the spin-off portfolio, not for the S&P 500. 16 separate new stocks vs. one of the cheapest ETF in the world, that’s not even close.

Strictly speaking, the S&P500 is not a valid benchmark here. To find an academically suitable benchmark, we have to take into account industry tilt, size, and so on. It is very likely that the main reason of this portfolio underperformance is the current regime, unfavorable for small caps and value stocks. But from the practical point if strategy’s alpha is not big enough to beat S&P500, why bother yourself at all?

This publication is for informational and educational purposes only. It is not investment advice, tax advice, or a recommendation to buy or sell any security. I am not a licensed financial advisor. Investing involves risks, including the possible loss of capital. Always do your own research or consult a professional before making financial decisions.

This is valuable work. The spin-off thesis always had an elegant logic—forced selling creates opportunity. But as you've shown, elegant logic doesn't always translate to edge.

What's particularly interesting is that the underperformance emerged in 2025, not immediately. This suggests the issue isn't the spin-off mechanism itself, but how these companies navigate the current environment. Small-cap value has been out of favor, and many spin-offs land squarely in that category.

Your conclusion feels right: spin-offs are a hunting ground, not a strategy. The announcement is a signal to look closer, not a reason to buy blindly. And that 3 out of 16 delivered 100%+ returns supports this—there were winners in the cohort, they just required selection.

Appreciate the rigor here. Too much investing advice relies on outdated theses that no one bothers to test anymore.

KVUE specifically caught my attention in this cohort because it had the brand portfolio and distribution but got hammered in the consumer staples selloff. The J&J spinoff thesis made sense on paper, but the timing put it right into a sector rotation away from defensive names. Your data confirms what the market showed us, that even quality consumer brands can't escape macro headwinds when they hit. The 16% averge performance really drives home that spin-offs need individual analysis, not blanket assumptions.