ChatGPT for stock-picking: could simple AI screening improve a portfolio?

A quick backtest + thoughts about AI’s place in investment research

Recently I wrote about my backtest of 25 undervalued stocks I picked from an archived stock screener. The results were surprisingly good: the portfolio beat the S&P 500’s annualized return by 7%.

Not all stocks were winners, 9 of them brought losses. I was going to analyze them more thoroughly to detect patterns that led to bad performance.

I started enthusiastically but soon realized that there was no single clear pattern. Each stock is unique, and analyzing each carefully means a huge amount of time and effort. It might be interesting academically, but I don’t want to do a PhD — I want a big, fat, thriving portfolio.

So I decided to test a shortcut: what if we ask AI to identify the best picks? Can it help to weed out losers and improve performance?

Here is my prompt:

Using the official statements only (earnings calls, filings etc.) available on December 1, 2024 (hard rule: no use of documents or statistics that are more recent), make a ranking from best to worst stocks over 1-year horizon. Explain ranking based on data, quotes from official documents and so on.

(+25 tickers copy-pasted from the previous article)

I used ChatGPT-5 (Thinking).

Here is the start of ranking:

ACGL — Arch Capital Group

Thesis: peak-quality insurer with exceptional underwriting & investment tailwinds; still compounding.PGR — Progressive

Thesis: personal lines pricing power still flowing through earned premiums; combined ratios sub-90s in 2H’24 months.BBVA

Thesis: record profitability, double-digit NII/fees growth, high-teens ROTE; 3Q print clean.

The results are mixed. On one hand the best-ranked ACGL is actually detrimental, as well as PGR. But! BBVA is actually a top performer with YTD around 90%.

What about TOP-10 of the ranking?

The results are much more consistent. Among the 10 ChatGPT picks, 6 stocks are in the real TOP-10.

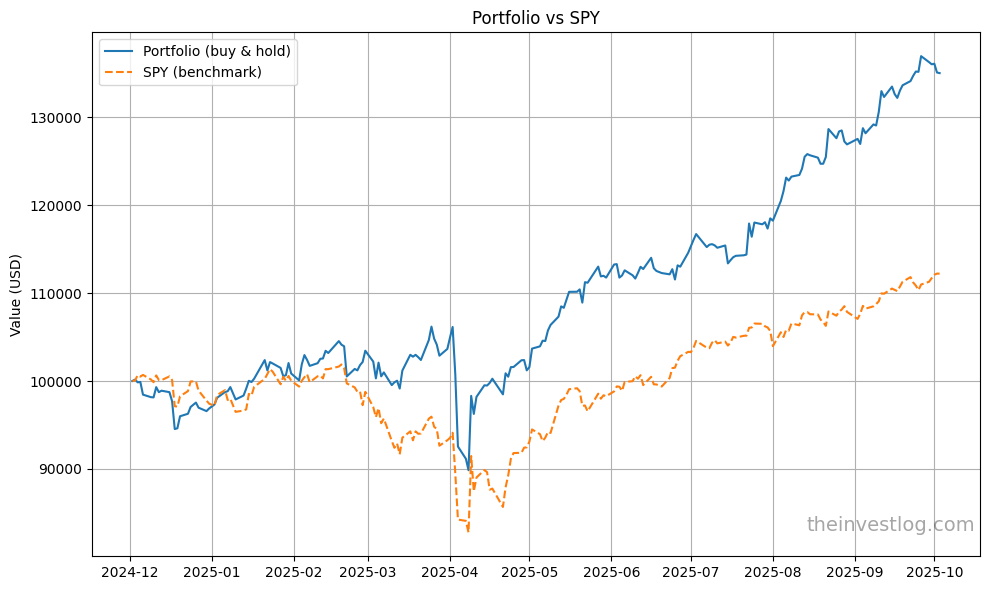

Then I ran a backtest: TOP-10 ChatGPT picks vs S&P 500, starting December 2, 2024 and ending October 10, 2025:

The difference is huge!

Top-10 ChatGPT picks:

Final Value: $135,015.23

Total Return: +35.02%

CAGR: 43.23%

Volatility: 21.47%

Sharpe Ratio: 1.79

Max Drawdown: -15.38%

SPY (Benchmark)

Final Value: $112,212.11

Total Return: +12.21%

CAGR: 14.78%

Volatility: 20.67%

Sharpe Ratio: 0.77

Max Drawdown: -18.76%

In my previous backtest the period started on 29.10.2024. Here I wanted to be sure that all 25 companies submitted their Q3 reports before the date in the prompt. To protect experimental integrity I had to start the backtest after the date in the prompt.

What does this mean for a practitioner investor, anyway?

Well, one case proves very little. Honestly, I did the backtest just out of habit, and I take the results with a grain a sack of salt.

There is no way to be sure that the ranking was not biased towards real winners because of GPT’s internal knowledge. Yes, I strictly stated in the prompt that we should rely only on the info available on December 1, 2024, and reasoning seems to comply. But it all can be just a rationalization of sorts.

On the other hand, AI seems to be quite capable of spotting risks, assessing guidance confidence and spotting lacking information. I think it is best to use AI as the second stage of screening: between quick filtering by fundamentals and painstaking manual analysis.

There is a danger that AI with a risk-oriented prompt will be too conservative and make some false negatives (i.e. flagging a potential superstar as high risk). But I can live with that. There are plenty of opportunities to invest and only so much time for research. Weeding out bad deals is more important.

I already started to use a more sophisticated prompt in my research. I will fine-tune it further and describe my experience in future posts. Stay tuned!

This publication is for informational and educational purposes only. It is not investment advice, tax advice, or a recommendation to buy or sell any security. I am not a licensed financial advisor. Investing involves risks, including the possible loss of capital. Always do your own research or consult a professional before making financial decisions.